In business, it’s common for companies to supply goods to other firms on a regular basis. However, cash flow issues can arise. For example, a buyer might request goods from a supplier but only be ready to pay after a month. In such cases, suppliers often seek financial help from banks or factoring companies to cover the transaction until the buyer makes the payment. But it’s not that simple: banks usually require collateral, factoring companies often charge high interest rates, and the documentation process can be time-consuming. Additionally, intermediaries often demand extra fees.

Editor's Note. What is Factoring? Factoring is a financial service that allows suppliers to receive immediate payment for deferred invoices. A financial institution pays the supplier upfront, and the buyer later reimburses the institution.

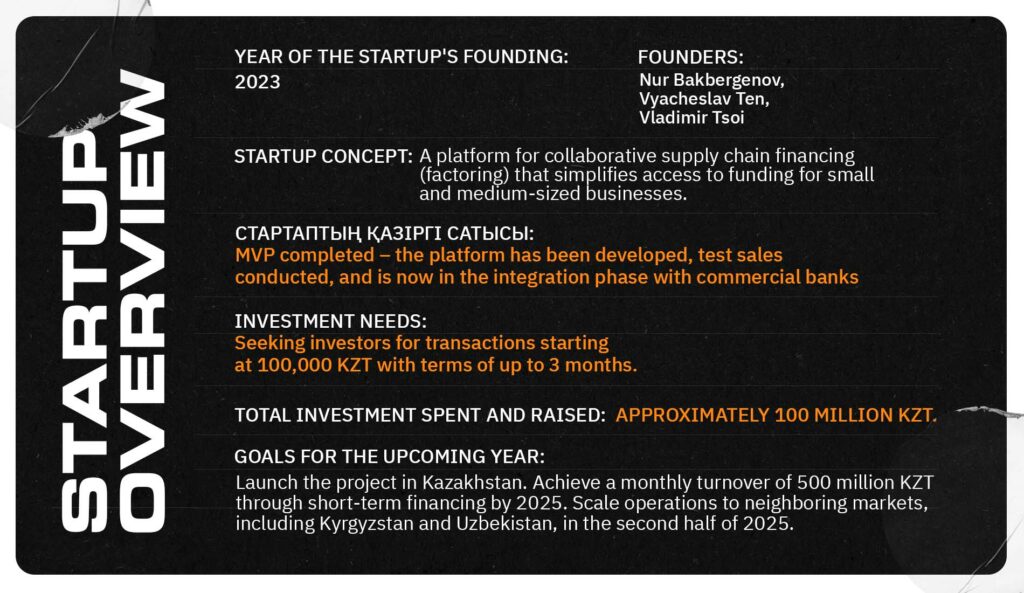

Kazakhstani startup Factoring On Blockchain (FOB) aims to solve these challenges with its blockchain-powered platform. The founders’ goal is to connect companies and investors, eliminate intermediaries, simplify and accelerate factoring processes, minimize paperwork, and boost operational efficiency.

In an interview with ER10 Media, co-founders Nur Bakbergenov, Vyacheslav Ten, and CTO and angel investor Vladimir Tsoi shared how their startup plans to revolutionize trade finance, scale internationally, and position factoring services as an attractive investment opportunity.

Follow Kazakhstan’s Startup Movement in the "100 Startup Stories of Kazakhstan", a collaborative project by ER10 Media and Astana Hub. This initiative highlights the most innovative Kazakh startups, showcasing projects that stand out for their creativity and impact. Among the heroes are Astana Hub residents, as well as creators of other innovative technological products and services. The content is available in Kazakh, Russian, and English.

Meeting Business Needs

— How did the idea for this startup come about? Factoring is quite a complex product.

Nur Bakbergenov: I have worked in banks for over 20 years in various positions This experience gave me a solid understanding of financial institutions' operations. However, I was often dissatisfied with traditional banking processes. I wanted to integrate modern technology into them. After leaving the banking sector and joining a payment organization, I became more familiar with decentralized finance (DeFi) technologies. That’s when the idea of creating a user-friendly and transparent financing service, particularly for factoring, began to take shape. I wanted to develop a tool that would make financial transactions faster, simpler, and more accessible.

We discussed the concept with friends, joined an accelerator program, and refined it into a full-fledged project. Vyacheslav contributed financial expertise, and Vladimir took charge of the technical aspect starting in early 2024.

Experience showed us that businesses had a pressing need for such a solution. I saw DeFi technology as the perfect way to make it a reality.

— What is the core idea of the startup? Why focus on factoring?

Nur Bakbergenov: Many trading companies face the challenge of delivering goods only to have the buyer delay payment. For instance, funds might not come in for a month, creating a cash flow gap that can be painful for businesses. According to our estimates, every 30 days in Kazakhstan, approximately 80 billion KZT becomes tied up in such gaps, disrupting the overall trade flow. Although banks work in this area, they have their own logic - they require collateral, comprehensive analysis and guarantees.

Our platform, Factoring On Blockchain, offers businesses a faster and simpler alternative.

Traditional factoring involves selling unpaid invoices. For example, a company delivers goods but receives payment later. A bank acts as the “factor,” advancing funds to the supplier and then collecting the payment (plus interest) from the buyer.

We developed a similar system but digitized the entire process. All documents and contracts are stored and processed on the platform.

Through our system, digital contracts are purchased by private investors in lots starting at 100,000 KZT. The lifespan of such contracts corresponds to the delivery and payment terms, typically ranging from 1 to 3 months.

Beneficial for Everyone

— Will you attract investors to this market? What’s in it for them?

Vyacheslav Ten: Imagine you’re an investor. On the platform, you see a company supplying goods worth 50 million KZT per month. They’re preparing for another deal. You review their financial data, assess the risks, and find that their payment history is stable. You decide to participate in the deal. You provide funds to the supplier, and within up to three months, you receive your money back from the buyer, along with interest. Transactions are executed seamlessly through banking apps. Overall, the returns for investors are comparable to bank rates.

— Is this model advantageous for suppliers?

Vyacheslav Ten: Absolutely. This approach solves suppliers’ cash flow challenges. No collateral or lengthy processing is needed. For many suppliers, this is an optimal solution. They borrow funds transparently and efficiently via the platform. During the pilot phase, we raised 15 million KZT for a supplier in just three days, fully completing the deal.

— What other useful features does the platform offer?

Nur Bakbergenov: We plan to introduce Islamic financing on the platform. In this model, the platform and investors enter into deals via partnership agreements. This eliminates interest payments, and instead, profits are shared. For Islamic investors and suppliers, we offer a product fully compliant with Sharia law. Blockchain technology ensures every step of the transaction is verifiable. Smart contracts will automate compliance with deal terms, streamlining the process further.

— How competitive are the platform’s rates for businesses?

Nur Bakbergenov: Let me share real results from the pilot. Suppliers paid 3% per month, equating to 36% annually. Investors earned 2.1% per month, or 25.2% annually. The difference covered banking fees, our operational costs, and other associated expenses.

— Is this a beneficial option for suppliers?

Vyacheslav Ten: Definitely. Currently, factoring companies, microfinance organizations (MFOs), banks, and crowdfunding platforms operate in this market. Our platform is significantly cheaper than crowdfunding, which is typically geared toward longer-term investments. MFOs and factoring companies often charge higher rates—around 5% per month. Our rates are comparable to banks but without requiring collateral, and we operate much faster.

— Have you encountered any challenges in your work?

Nur Bakbergenov: Yes, there’s a regulatory challenge. Based on formal criteria, our platform could be misclassified as a financial pyramid. From an outside perspective, it may look like we’re taking money from people, placing it somewhere, and returning it with interest. We are addressing this by ensuring our model is compliant with financial legislation and utilizing blockchain technology to maintain transparency and accountability.

— And how are you addressing this issue?

Nur Bakbergenov: In the initial pilot, we only used founders' funds to comply with regulations. Moving forward, we aim to leverage the infrastructure of banks. Investors won’t transfer money directly to the platform. Instead, they will open escrow accounts, with the bank executing deal instructions. Documents and offers will be uploaded to the blockchain, and the platform will monitor and verify the transactions. Banks and investors will have access to information about companies, the location of goods, and payment timelines. Everything will be transparent. All data will be recorded on the blockchain, ensuring the transparency and reliability of the entire operational chain.

— How are investors’ interests protected? What if something goes wrong with the delivery?

Nur Bakbergenov: First, the supplier is responsible for the goods. They receive the funds and are obligated to fulfill the delivery. Second, many contracts are insured, so in case of unforeseen circumstances, the money will be reimbursed. Third, on the Factoring On Blockchain platform, investors can always track the location of goods and the details of the deal. Of course, there’s a risk that during the transaction period—say, one month—a company could go bankrupt. To address this, we plan to establish a compensation fund. Fourth, blockchain technology allows investors to purchase various tokens and diversify their investments. Instead of putting money into a single contract, they can invest in a hundred deals, distributing their risks—similar to an ETF.

Big Plans

— Do you plan to become an international unicorn?

Vyacheslav Ten: Absolutely. We aim to expand step by step into new markets and, ultimately, grow into a major fintech startup.

— What stage is Factoring On Blockchain at right now?

Vladimir Tsoi: We’ve completed development, conducted a pilot, secured a 17-million-tenge grant from QazInnovations, which we successfully utilized, and finalized the platform’s pivot. We are currently at the integration stage with two banks - one commercial and one Islamic.

Nur Bakbergenov: As soon as we complete the integration and resolve the licensing issue, we’ll be ready to start full-scale operations and promote the project. We plan to launch in 2025, allowing us to attract both companies and investors. In any case, we are already seeing interest from investors and businesses—they genuinely like our product.

This model can be further developed along the value chain, for instance, by offering deferred payment options for buyers (reverse factoring). This, too, is achievable with modern digital technologies.

— Does the startup need investments? If so, how much?

Nur Bakbergenov: At this stage of integration, we’re not seeking investments yet but plan to do so later. We currently have two business angels who have collectively contributed around 60 million tenge. Additionally, venture investors have shown interest in helping us scale, but they want to see the results of our platform’s launch in Kazakhstan first. I also believe that banks could become future stakeholders, as the platform can be seamlessly integrated into their products and infrastructure.

— Do you think your product could evolve into something bigger, covering other sectors?

Vladimir Tsoi: Yes, DeFi technology has vast potential. Just as we digitize contracts, we can also digitize assets such as rental properties. For example, imagine you own a 1,000-square-meter space that generates rental income. We could tokenize the property, dividing it into digital tokens. You could sell a portion of these tokens to investors to raise funds for business development. The token buyer would gain the right to a share of the profits, while you retain ownership and control of the property.

— Tell me, do you have competitors in Kazakhstan and abroad?

Nur Bakbergenov: There are many factoring projects in Kazakhstan. Just last year, we came across five startups operating in this space. However, they work on a different principle—they aim to participate in deals using their own funds, which imposes limitations. That said, the model of our platform allows us to become partners with these startups and collaborate effectively.

Vyacheslav Ten: Similar projects exist in Russia and Malaysia. While we’re not competing with them yet, we plan to enter these markets eventually and compete directly. We’re preparing for that. As for Islamic factoring, I haven’t seen similar projects or solutions in this space.

When to Become an Entrepreneur, If Not Now?

— Let’s talk about you. How did you become an entrepreneur?

Nur Bakbergenov: As I mentioned, I worked in the banking sector for over 20 years, even managing subsidiaries in Russia and Armenia. I had experience in project-based work, but at some point, I realized that technology had moved ahead, while I was still stuck in operations. I wanted to launch a tech startup that would make a real difference. The idea gradually formed during my participation in the Startup Garage accelerator at Astana Hub. Looking back, I see there were missteps and lessons learned along the way, but they’ve provided valuable experience. We plan to launch the company in Kazakhstan, expand into different sectors and eventually enter international markets. For example, our Islamic financing product could give us quick access to the Middle East and Southeast Asia, where there’s already interest.

— Have you thought about your startup’s mission?

Nur Bakbergenov: Lately, I’ve been reflecting on the concept of justice. I believe our startup brings us closer to it. First, we’re contributing to a system that is more transparent and understandable. Second, we ensure that profits stay with those who do the work—entrepreneurs and investors—rather than intermediaries. We make their lives significantly easier. This principle aligns with the foundations of Islamic finance and the broader vision of open, honest financial relationships. If we compare finance to a stream of water, the fewer obstacles it encounters, the faster it flows and benefits everyone.

— What inspires you in your work? Books, movies?

Nur Bakbergenov: One of the key movies that inspired me to leave banking and pursue entrepreneurship was Unlimited. It vividly shows how personal energy can transform reality and surroundings. I realized the difference between one state and another is energy level. That’s when I thought, “Why not?” and took the leap into entrepreneurship.

— Do you enjoy being an entrepreneur?

Nur Bakbergenov: Yes, it has its own kind of thrill. Now, I’m my own boss. I’ve grown unaccustomed to sitting through dull meetings. Instead, I get my adrenaline from generating hypotheses and testing them. For a long time, I had many obligations to my family. Now that my son is grown and my parents are doing well, I asked myself, “If not now, when?”

— What sport do you think reflects your entrepreneurial character?

Nur Bakbergenov: I’d say there are two. Since 1993, I’ve practiced aikido, where I learned to see potential opponents as partners and guide them toward where they want to go. The other is Go, which I play with friends. Decision-making is essential in both the game and business. It’s fascinating to draw parallels: how we assess situations, perceive risks, and sometimes even find solutions to real problems during a game. The courage to dream, relying on strengths, and maintaining a big-picture perspective—these are the key lessons Go has taught me.